Asset Fractionalization with SPARK+: Own a Piece of the Pie

SPARK+ specializes in making high-value assets more accessible to investors through the process of asset fractionalization. By dividing an asset into smaller, more affordable units, we enable investors to own a piece of an asset that would otherwise be out of reach. Our platform leverages the power of blockchain technology to securely and transparently fractionalize assets and make them available to investors.

How does asset fractionalization work?

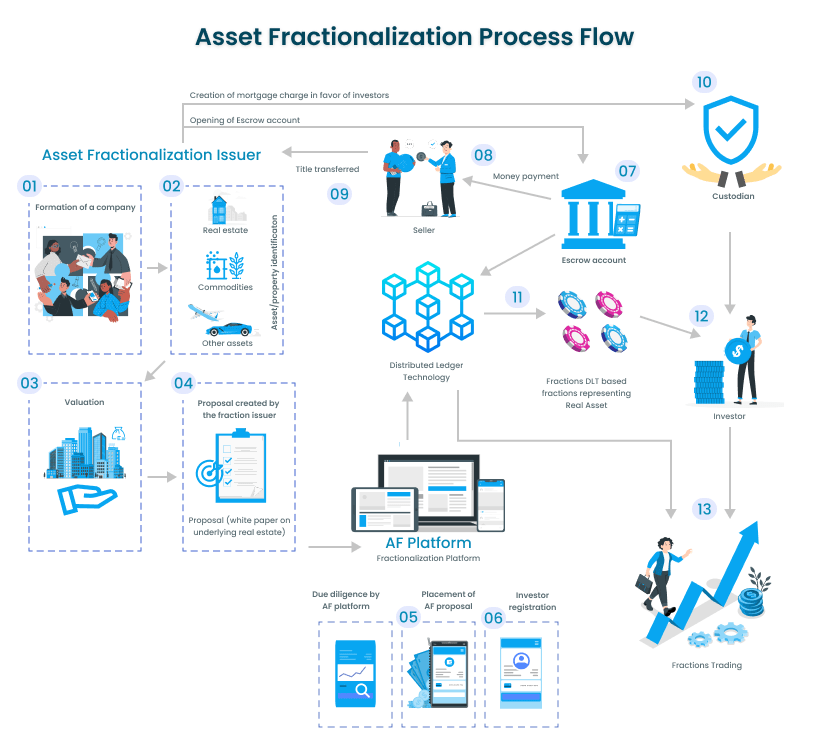

Asset fractionalization involves the creation of digital tokens that represent ownership rights in an underlying asset. These tokens are created and managed using blockchain technology, which allows for secure and transparent tracking of ownership and transactions. The underlying asset is typically held by a custodian or trust, and the tokens are sold to investors who wish to own a fraction of the asset. The tokens can be bought and sold on secondary markets, allowing for liquidity and price discovery. The income generated by the underlying asset, such as rent or dividends, is distributed to token holders in proportion to their ownership.

Use Cases

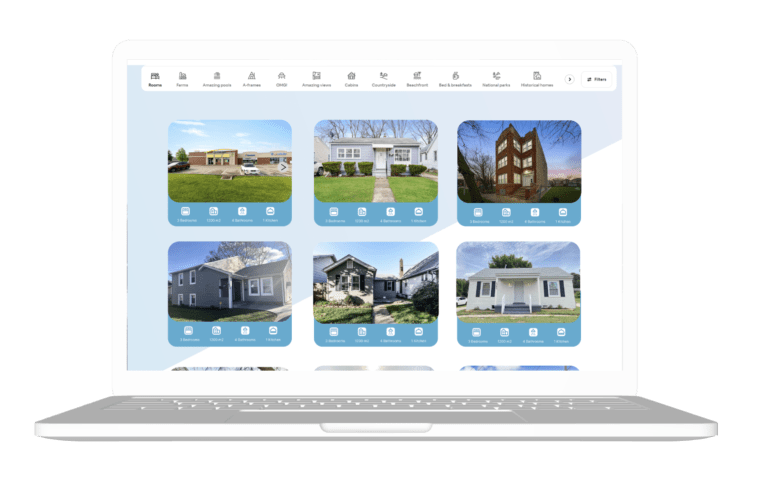

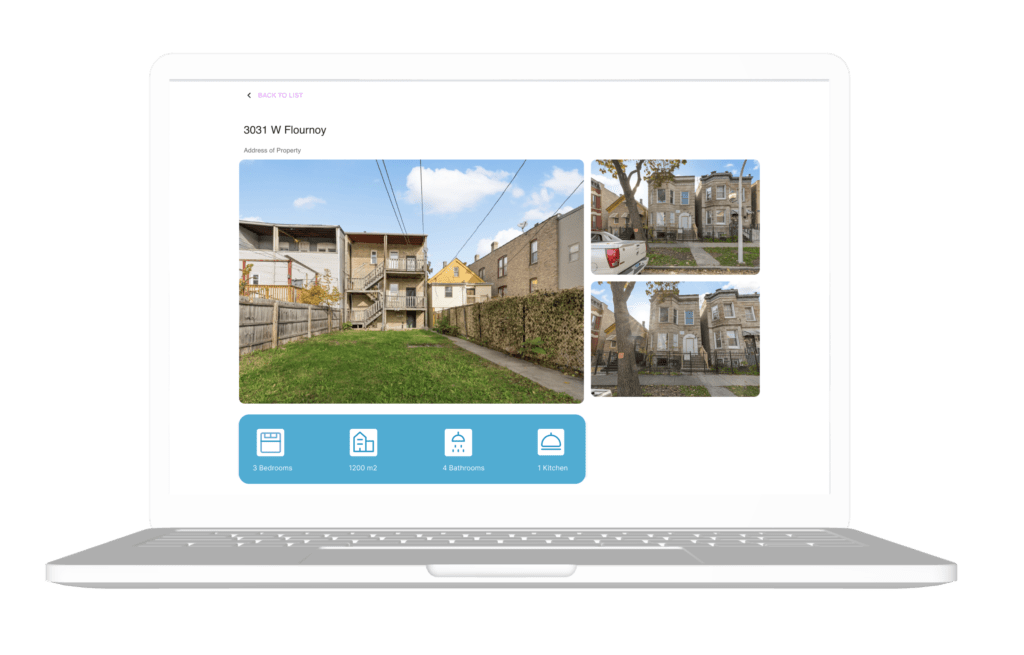

Real estate

By fractionalizing real estate properties, the barriers to entry for investors can be lowered, allowing them to diversify their portfolio and benefit from rental income and capital appreciation. This can also create more liquidity for property owners who want to sell their assets faster and easier.

Art

The art market can be democratized through the fractionalization of art pieces, allowing more people to own and appreciate artworks that are usually reserved for wealthy collectors and institutions. This can also increase the liquidity and transparency of the art market, as well as protect the provenance and authenticity of the artworks.

Collectibles

In addition to selling tickets, SPARK+ Technologies’ blockchain-based ticketing platform also makes it easy to manage event registrations. The platform provides a simple and intuitive interface for managing attendee information, ensuring that companies always have an up-to-date list of who’s coming to their event. This means that companies can focus on creating a great event experience, rather than worrying about registration details.

Private equity

Participation in the funding and growth of startups and private companies can be enabled by fractionalizing private equity. This can also provide more liquidity and flexibility for founders and shareholders who want to exit or diversify their holdings.

Debt

Access to the credit market can be allowed for more lenders and borrowers by fractionalizing debt. This can also reduce the risk and cost of lending and borrowing by diversifying the exposure and facilitating the repayment.

Other assets

New markets and sources of value for investors and owners can be created by fractionalizing other assets, such as commodities, intellectual property, or carbon credits. This can also improve the efficiency and sustainability of the allocation and utilization of these assets.

Investors

Access to illiquid assets: Asset fractionalization allows us to access illiquid assets that would otherwise be out of our reach.

Reduced investment minimums: Asset fractionalization reduces the investment minimums for many assets, making them more accessible to a wider range of investors.

Increased liquidity: Asset fractionalization can increase the liquidity of assets, making it easier for us to buy and sell them.

Increased transparency: Asset fractionalization can increase the transparency of assets, making it easier for us to understand the risks and rewards involved.

Asset owners

Access to new sources of capital: Asset fractionalization can give asset owners access to new sources of capital, which can be used to grow their businesses or invest in new projects.

Increased liquidity: Asset fractionalization can increase the liquidity of assets, making it easier for asset owners to sell them when they need to.

Increased transparency: Asset fractionalization can increase the transparency of assets, making it easier for asset owners to track their performance and manage their risks.

Asset managers

Increased efficiency: Asset fractionalization can increase the efficiency of asset management, as it allows asset managers to pool assets and manage them more effectively.

Reduced costs: Asset fractionalization can reduce the costs of asset management, as it allows asset managers to share resources and economies of scale.

Increased investor base: Asset fractionalization can increase the investor base for asset managers, as it makes it easier for them to reach a wider range of investors.

Features

Democratization

Democratizes access to high-value assets by lowering barriers to entry for investors.

Liquidity

Increases liquidity by enabling fractional ownership to be traded on secondary markets.

Price discovery

Improves price discovery by allowing more market participants to value the asset.

Diversification

Diversifies investment portfolios by providing exposure to a wider range of assets

Risk reduction

Reduces risk by enabling investors to spread capital across multiple assets.

Transparency

Enhances transparency by using blockchain technology to track ownership and transactions.

Provenance and authenticity

Protects the provenance and authenticity of assets such as art and collectibles.

Debt repayment

Facilitates debt repayment by diversifying the exposure of lenders and borrowers.

Private equity participation

Enables more investors to participate in funding and growth of startups and private companies.

Founder and shareholder flexibility

Provides liquidity and flexibility for founders and shareholders who want to exit or diversify holdings.

New markets

Creates new markets and sources of value for investors and owners of commodities, intellectual property, or carbon credits.

Efficiency and sustainability

Improves efficiency and sustainability of allocation and utilization of these assets.

Small investor benefits

Allows smaller investors to reap the benefits of high-value illiquid asset classes.

Collector opportunities

Opens up opportunities for collectors who want to own a piece of history or culture.

Valuation, verification, and exchange

Creates an efficient way of valuing, verifying, and exchanging collectibles.

Investor exposure

Offers investors exposure to mainstream indices and a range of thematic and specialized assets.

Income distribution

Distributes income generated from the underlying asset to token holders in proportion to their ownership.

Affordable investment opportunities

Turns high-value assets into affordable investment opportunities for smaller investors.

Cyborpay

Crypto Wallet and Payments

Crypto Wallet & Payments

- Turkey

Galaxii

Decentralized Video & NFT Platform

Decentralized Social Media & Community

- USA

WEMP

Women Empowerment Token

Decentralized Finance

- USA

Autobet

Decentralized Lottery & Gaming

Lottery & Gaming

- New Guinea

Decentralized Identity

SSI Based Identity Management

Decentralized Identity

- USA

Artistry

NFT Marketplace for Artists

Asset Management & NFTs

- USA

Smart Ballot

Blockchain Based Voting System

Voting & DAO

- USA

Diamond Supply Chain

Blockchain Based Supply Chain

Supply Chain

- UK

Followgoa

Experiential Travel and Tourism

Travel & Tourism

- India

EXCELLENT

EXCELLENT

Autobet

RateMyGrass

SparkLand

Diamond Supply Chain

BookMyTrek

Cyborpay

Weedcommerce

FAQs

What is asset fractionalization?

Asset fractionalization refers to dividing an asset into smaller parts or “fractions” that represent ownership rights. This allows multiple individuals to own a share of a single asset, such as real estate, artwork, or securities, rather than one person owning the entire asset.

How does asset fractionalization work?

Asset fractionalization typically involves the use of blockchain technology to create digital tokens that represent ownership rights in an underlying asset. These tokens can be bought and sold by investors who wish to own a fraction of the asset. The underlying asset is usually held by a custodian or trust, and transactions are tracked securely and transparently using blockchain technology.

What are the benefits of asset fractionalization?

Asset fractionalization can provide several benefits, including democratizing access to high-value assets by lowering barriers to entry for investors, increasing liquidity by enabling fractional ownership to be traded on secondary markets, improving price discovery by allowing more market participants to value the asset and diversifying investment portfolios by providing exposure to a wider range of assets.

What types of assets can be fractionalized?

Many different types of assets can be fractionalized, including real estate, art, collectibles, private equity, debt, commodities, intellectual property, and carbon credits. Fractionalization can create new markets and sources of value for investors and owners of these assets.

Is asset fractionalization regulated?

The regulation of asset fractionalization varies depending on the jurisdiction. Some countries have proposed or implemented rules to govern the process of asset fractionalization and protect investors from fraud and abuse. It is important for investors to understand the regulatory environment in their jurisdiction before participating in asset fractionalization.

What is the role of blockchain technology in asset fractionalization?

Blockchain technology plays a crucial role in asset fractionalization by providing a secure and transparent way to track ownership and transactions of digital tokens that represent ownership rights in an underlying asset. Blockchain’s decentralized and tamper-resistant nature ensures that ownership records are accurate and immutable.

How does asset fractionalization benefit smaller investors?

Asset fractionalization can benefit smaller investors by lowering the barriers to entry for investing in high-value assets. By dividing ownership rights into smaller fractions, it can make it more affordable for smaller investors to own a piece of the asset and share in its benefits, such as income generated from rent or appreciation in value.

Can asset fractionalization increase liquidity?

Yes, asset fractionalization can increase liquidity by allowing fractional ownership to be bought and sold on secondary markets. This can make it easier for investors to buy and sell their ownership rights, and can also improve price discovery by enabling more market participants to value the underlying asset.

What are the risks associated with asset fractionalization?

As with any investment, there are risks associated with asset fractionalization. These risks can include market risk, liquidity risk, regulatory risk, and counterparty risk. It is important for investors to thoroughly research and understand the risks associated with asset fractionalization before investing.

How does asset fractionalization impact traditional markets?

Asset fractionalization can have a significant impact on traditional markets by creating new opportunities for value creation and exchange. By dividing ownership rights into smaller fractions, it can lower the barriers to entry for investors, increase liquidity and transparency, and create new markets for assets that were previously difficult to trade.